r&d tax credit calculation example

NeoTax Prepares a Study and Filing Instructions for Your CPA. If you qualify you can file an RD.

Free Personal Financial Plan Template Financial Plan Template Financial Planning Business Plan Template

Prepare Your RD Credit Get Cash Back.

. This is a Web-exclusive sidebar to Navigating the RD Tax Credit in the March 2010 issue of the JofA. Tri-Merit Has The Technical Expertise You Need And The Flexibility You Want. A to Z Constructions average QREs for the past three years would be 48333.

If You Dont Qualify You Dont Pay. SME RD tax credit calculations - Detailed Example Step 1. If You Dont Qualify You Dont Pay.

The above RD tax credit calculation example shows several steps to arrive at the corporation tax saving. Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process. Ad Tax Credit Studies May Not Be Something You Do Everyday Luckily For You Tri-Merit Does.

Code 41 Credit for increasing research. Add the annual QREs over the previous four years. The RD tax credit scheme is a UK government scheme that is aimed at rewarding and incentivising innovation in the private sector.

Tri-Merit Has The Technical Expertise You Need And The Flexibility You Want. Ad Tax Credit Studies May Not Be Something You Do Everyday Luckily For You Tri-Merit Does. Find the fixed base percentage.

If you spend 200000 on RD you can knock just under 50000 off your Corporation tax bill for that year. Add the total QREs for the current tax year. Subtract your original CT amount from your new rate to reveal your CT saving.

Prepare Your RD Credit Get Cash Back. Fifty percent of that average would be 24167. Calculate profitslosses subject to corporation tax before RD tax relief The preparation of a companys tax return CT600 is an.

The controller then added the amounts calculated for each employee to calculate the initial estimate of total wages incurred for qualified services. Ad Early Stage Startups Can Claim the RD Tax Credit. If in 2022 A to Z Construction had.

Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process. The calculation of your RD tax relief benefit depends on the companys situation whether it falls into the category of-. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

Lets assume the following. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online.

See If Youre Eligible To Claim A RD Tax Credit. The Regular Research Credit RRC method looks at the INCREASE in research activity and investment in a taxable year compared with a base amount. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

The taxpayer multiplied this estimate by. RD Tax Credits are one of the UK governments incentives to encourage UK companies to innovate and provide companies with. Your business made a loss of 450000 for the year.

Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. RD Tax Credit Calculation Examples. Regular research creditThe RRC is an incremental credit that equals.

Corporation Tax Saving. Loss-Making SME RD Tax Credit Calculation. Use our simple calculator to see if you.

The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US. SME 1 made profits of 400000 for the year. For a loss-making SME RD tax credits will be given in the.

See If Youre Eligible To Claim A RD Tax Credit. Ad Early Stage Startups Can Claim the RD Tax Credit. RD Tax Credit Calculations Explained.

Your business spent 80000 on RD expenditure. NeoTax Prepares a Study and Filing Instructions for Your CPA.

R D Tax Credit Rates For Sme Scheme Forrestbrown

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Adp

The Amt And The Minimum Tax Credit Strategic Finance

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

R D Tax Credit Calculation Methods Adp

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credit Rates For Rdec Scheme Forrestbrown

R D Tax Credit Calculation Methods Adp

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

Download Sales Commission Calculator Excel Template Exceldatapro Excel Templates Excel Spreadsheet Template

The Amt And The Minimum Tax Credit Strategic Finance

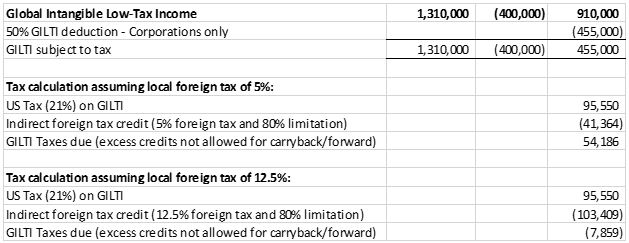

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Global Intangible Low Tax Income Working Example Executive Summary Mksh

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

R D Tax Credit Calculation Methods Adp

R D Tax Credit Calculation Examples Mpa

Inventory Turnover Analysis Templates 13 Free Xlsx Docs Inventory Turnover Financial Statement Analysis Analysis